Much of our reported research over the last several months has focused on how the automotive claims and collision repair industries are experiencing lifts in both auto claim frequency and cost, returning in many ways to pre-recession trends. When we look at the broader demographics however we see that the U.S. saw little to no slowdown in changes to its population. As the U.S. population continues to age and become more diverse these changes will ultimately impact these industries as well.

Demographics of Age

In prior issues of Crash Course, we have discussed the differences in behavior and expectations of the first truly digital generation – the Millennials. This is a generation of many firsts:

- The Millennial Generation is the best-educated cohort of young adults in America, but two-thirds of those graduating with a bachelor’s degree have loans averaging $27,000.1

- According to Pew Research, Millennials are the most racially diverse generation, with the highest share (43 percent) of non-white than any other generation to date.2

- Highest share of individuals who consider themselves political independents (50 percent versus 39 percent for Gen X; 37 percent for Baby Boomers, and 32 percent for Silent).3

- As of 2013 only 26 percent of individuals aged 18 to 32 were married versus 65 percent of the Silent Generation and 48 percent of the Baby Boomers when they were at a comparable age.4

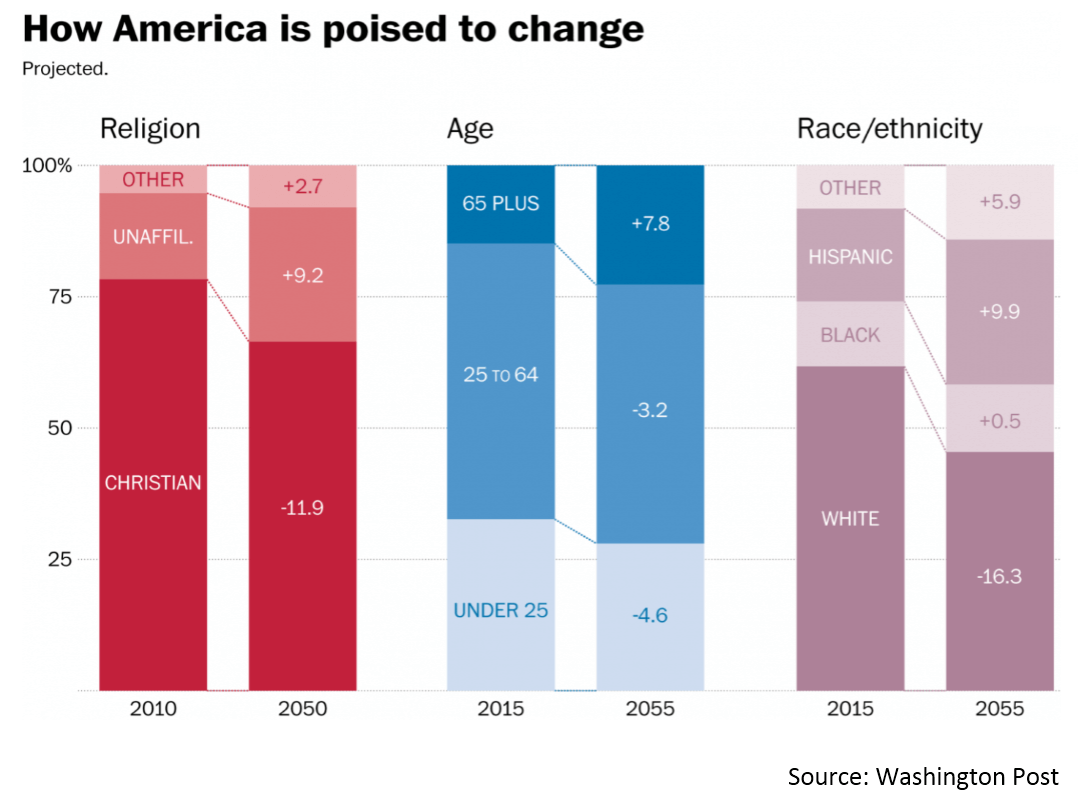

While Millennials have been perhaps the most-talked about generation in the last several years, they like all other generations have gotten older. The U.S. is seeing its population get older – by 2050 the median age in the U.S. is expected to be 41 years versus 37 in 2010.5

According to estimates from the U.S. government, the U.S. population will grow by 70 million by 2045 – more than the current populations of NY, TX and FL combined.6 By 2045 the number of Americans aged 65 and older will also grow 77 percent.7

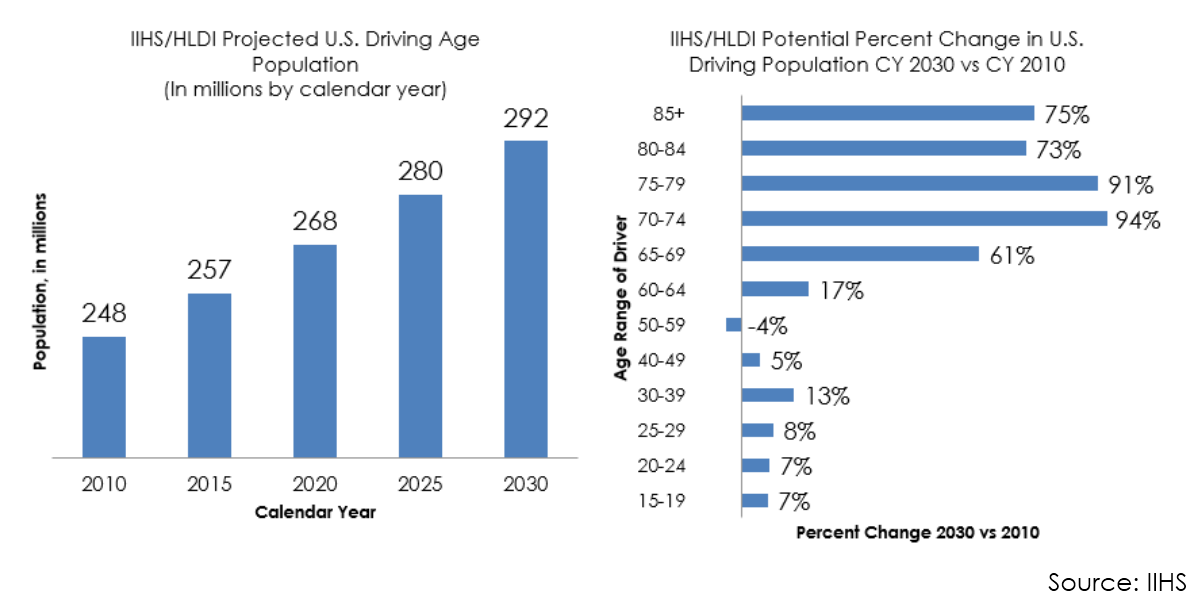

With population growth, the number of drivers in the U.S. is expected to grow as well.

Research from the Insurance Institute for Highway Safety projects over 10 percent growth in the U.S. driving age population between CY 2015 and 2030, with the greatest growth among the older age brackets.8

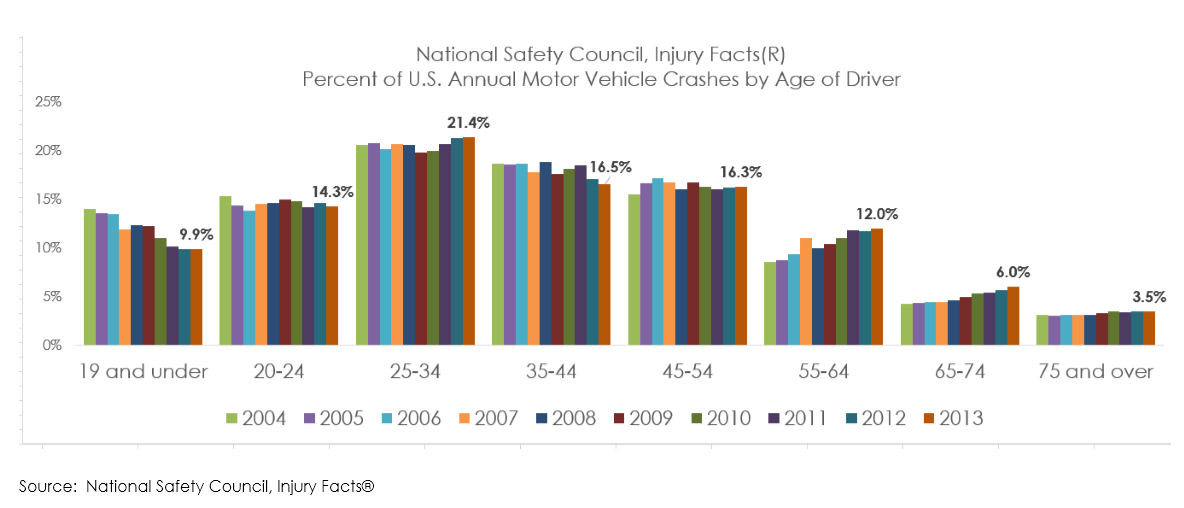

Historically accident frequency declines as the age of the driver increases – data from the National Safety Council from CY 2003 to 2014 shows drivers aged 25-34 consistently account for the largest share annually.9 With more growth in the sheer number of older drivers, that should only continue to help reduce auto claim frequency further in the future.

And while teens have historically also had very high accident rates, the sheer number of teenagers in the U.S. actually has fallen steadily. In fact, data from the U.S. Census Bureau shows the percentage of the country that are teenagers has never been as low as it is today.10

The recession led many individuals to postpone retirement, but even now with the economy improving, many baby boomers are choosing to phase in retirement. A 2013 study “Americans’ Perspectives on New Retirement Realities and the Longevity Bonus” by Merrill Lynch with Age Wave found respondents were interested in continuing work in the fields in which they built their careers.11 And 60 percent of older Americans have a career transition to a bridge job before retiring according to research from the Sloan Center on Aging and Work at Boston College.12

Numerous consulting firms have popped up over the last several years to provide a way for companies to take advantage of these experienced individuals. For example, Wahve is one such firm whose goal “is to make hiring highly experienced, qualified insurance professionals easy, and to provide vintage insurance professionals who want to “pretire” the opportunity for a continued career working from home.”13

Working longer is not the only way that baby boomers are changing traditional views of aging. The need to retool for an aging world was identified by JWTIntelligence as a major trend that will be felt in 2015, shaping societal mood, behaviors, and attitudes.14

According to data from the U.S. Bureau of Labor and the Census Bureau, American aged 55-plus have among the lowest rates of unemployment and the most wealth of all other age brackets.15 In the U.K., individuals aged 50-plus control 80 percent of the wealth.16 Yet according to data from Fast Company, only 5 percent of advertising budgets worldwide target older consumers, while 80 percent is spent trying to reach 18-34-year-olds.17

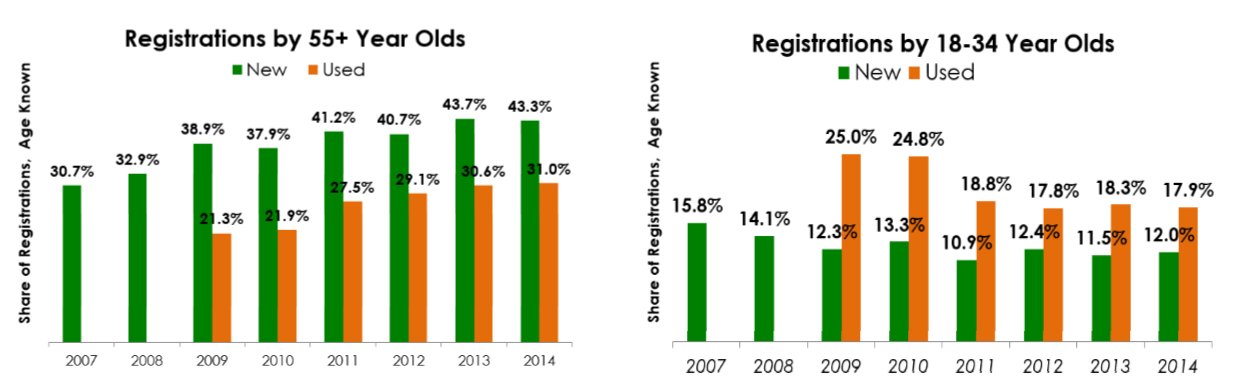

In the U.S., Americans aged 55-plus continue to purchase more vehicles than other age groups. Data from Chief Economist Lacey Plache from Edmunds.com reveals 43.3 percent of new vehicle registrations and 31 percent of used vehicle registrations in the U.S. in CY 2014 were for individuals in this age bracket.18 New vehicle registrations for Millennials however are still down nearly 25 percent from CY 2007 levels.19

In fact, according to Edmunds.com, 78 percent of the vehicles bought by Millennials in CY 2014 were used.20 Used vehicle prices have remained elevated coming out of the recession, however, increases in supply of newer model used vehicles are expected to soften prices over time.21 With Experian data showing over 55 percent of used vehicle purchases sold with financing,22 carriers may want to ensure their Millennial customers have a solid understanding of the depreciation cycle of a vehicle, and the potential impact that may have if the vehicle is involved in an accident that totals the vehicle.

With more vehicle registrations annually still coming from those in the U.S. aged 55-plus than Millennials,23 insurance companies and collision repairers should pay attention to their own marketing, to ensure they address not only the needs and desires of the changing Millennials generation, but of those aged 55-plus, who are also changing, and remain a very large opportunity.

The 55-plus demographic may historically have fewer accidents,24 but with many working longer before full-retirement, they continue to drive at peak driving times, and may see different claim patterns than previous generations.

Demographics of Race

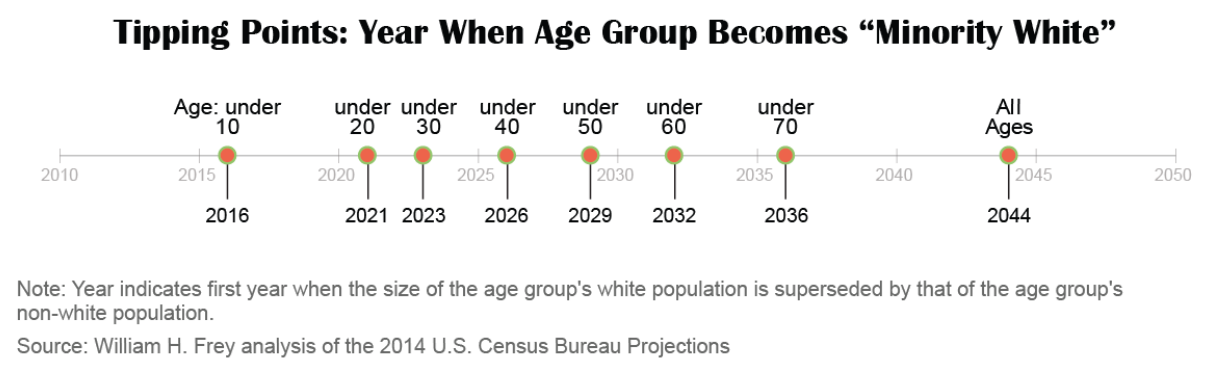

In 2014, data from the U.S. Census Bureau shows that for the first time, more than 50 percent of children under the age of 5 in the U.S. were minorities, versus 37.9 percent for the total population.25 And by 2044, analysis by William Frey of the Brookings Institute estimates, the U.S. white population will be exceeded by the non-white population, with different age groups seeing this occur faster than others.26

The automotive industry like many has already begun to see the growth opportunity within the changing demographics – particularly among Hispanic buyers. According to IHS Automotive’s Polk market data unit, total industry retail sales increased 5.9 percent in 2014, but retail sales to Hispanic consumers rose 15 percent.27 These consumers will then also be purchasing insurance, and subsequently carriers must be knowledgeable about differences in how they prefer to be marketed and sold to.

Data from Pew Research has shown different demographics have a greater reliance on smartphones as their primary means of accessing the internet. Among those Americans that are most reliant are younger adults and non-whites: 12 percent of African-Americans and 13 percent of Latinos compared with 4 percent of whites.28

As the population shifts to less than 50 percent whites in the next several decades, the ability for companies to market themselves in a mobile environment becomes that much more important. Mobile strategies will grow important in areas such as employee recruiting as well – the Pew Research data finds 63 percent of smartphone-dependent users got job information on their phone in the last year, and 39 percent used their phone to submit a job application.29

Summary

There is a great deal of research available documenting the numerous demographic changes occurring in the U.S. to date and anticipated for the future. Many of these demographic shifts have been in place for many years already, and will continue to evolve with time. Most however are large scale, slow moving, so businesses have time to adapt their marketing, sales, and service plans accordingly. Those that have done nothing to date are behind, but technology can help reduce the gap. Millennials are the first generation to truly grow up ‘digital’, but others have quickly followed suit in the adoption of digital technologies. Subsequently we will continue to see changing expectations among all age groups and races in terms of what they expect and how they shop.

Sources:

1 Pew Research Center, March 2014. “Millennials in Adulthood: Detached from Institutions, Networked with Friends.” www.pewresearch.org.

2 Ibid.

3 Ibid.

4 Ibid.

5 Pew Research Global Attitudes Project. “Attitudes about Aging: A Global Perspective.” January 30, 2014, www.pewglobal.org. p. 7.

6 U.S. Department of Transportation. “Beyond Traffic 2045: Trends and Choices. http://www.transportation.gov/BeyondTraffic, March 20, 2015.

7 Ibid.

8 Insurance Institute for Highway Safety. “Smart Connections” panel, CCC Industry Conference, 2015.

9 National Safety Council- Injury Facts® 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015

10 http://www.washingtonpost.com/blogs/the-fix/wp/2015/04/04/teenagers-have-never-been-a-smaller-portion-of-our-population/

11 Merrill Lynch Wealth Management® and Age Wave. “Americans’ Perspectives on New Retirement Realities and the Longevity Bonus.” Copyright 2013 Bank of America Corporation.

12 Zipkin, Amy. “Consulting as a Bridge Between Full-Time Work and Retirement.” www.nytimes.com, Feb 6, 2015.

13 http://www.wahve.com/about-us/.

14 “10 Year of 10 Trends.” www.jwtintelligence.com, January 14, 2015.

15 www.bls.gov and www.census.gov.

16 “Q&A, Marie Stafford, JWT London’s director of Planning Foresight on Boomer consumers.” www.jwtintelligence.com, February 11, 2015

17 Jack, Louise. “Rise of the Olds: Advertising Catches Up with With A New Demographic.” http://www.fastcocreate.com/1679811/rise-of-the-olds-advertising-catches-up-with-a-new-demographic.

18 Plache, Lacey, Edmunds.com. Data from Polk and Edmunds.com, 2007-2014. Presentation given at CCC Industry Conference, May 2015.

19 Ibid.

20 “Nearly Four-Fifths of Millennial Car Purchases Were Used in ’14.” www.autoremarketing.com, April 15, 2015

21 www.manheimconsulting.com.

22 Experian State of the Automotive Finance Market First Quarter 2015.

23 Plache, Lacey, Edmunds.com. Data from Polk and Edmunds.com, 2007-2014.

24 National Safety Council: Injury Facts® 2005, 2006, 2007, 2008, 2009, 2010, 2011, 2012, 2013, 2014, 2015.

25 U.S. Census Bureau. July values from 2014 Population Estimates and 2000-2010 Intercensal Population Estimates. www.census.gov.

26 Bradley, Jennifer. “Changing Face of the Heartland: Preparing America’s Diverse Workforce for Tomorrow.” www.brookings.edu/research/essays/2015.

27 Chappell, Lindsay. “Sales to Hispanics outpacing the market.” www.autonews.com, May 18, 2015.

28 Pew Research Center, April 2015. “The Smartphone Difference.” www.pewinternet.org/2015/04/01/us-smartphone-use-in-2015.

29 Ibid.