I’m pleased to announce our 2016 issue of Crash Course is now available via the CCC website.

The title of this year’s publication is “Inflection Point” – which is perhaps the best way to describe where we are at the start of 2016. Andy Grove, Intel’s co-founder, described a strategic inflection point as “an event that changes the way we think and act.”1

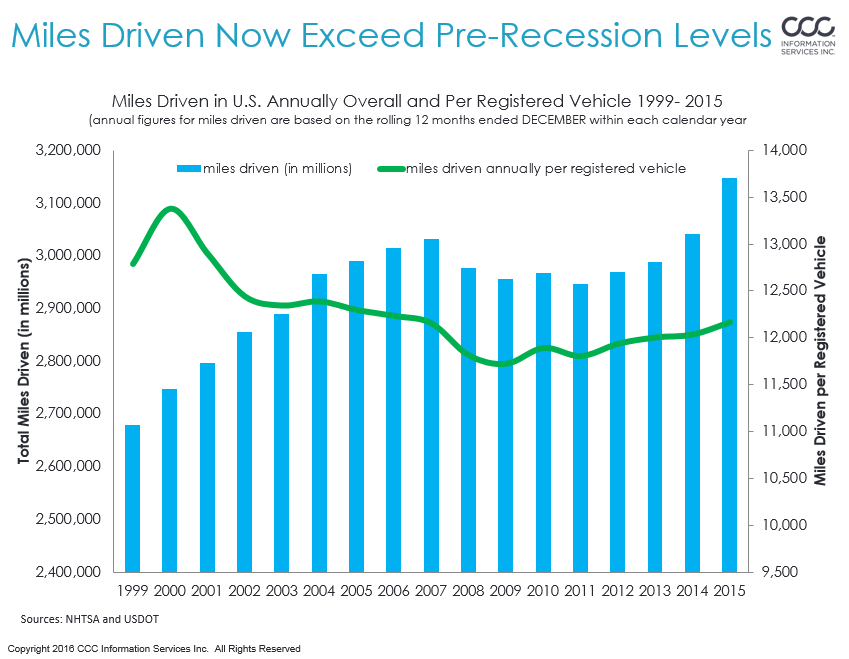

Consumers are back at work, spending more time behind the wheel, and quickly adapting to a world that is rapidly becoming more digital and distracting. The technology that nearly every consumer now holds in their hands has shaped their expectations, driving waves of change not only in consumer electronics but also in the vehicles they purchase.

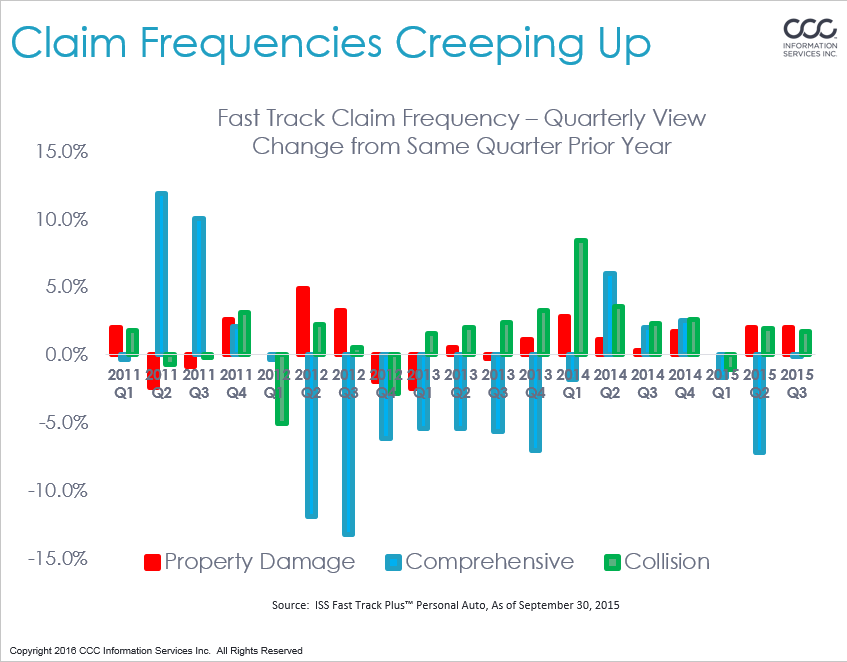

More accidents means more repair jobs for the collision repair industry. Repair order volumes are up, consumers are buying more vehicles again, driving them more, and creating more volume for the industry.

Several key questions for the next several years is whether or not gas prices will remain low (all signs seem to point to just that), and whether continued low gas prices will further push up miles driven per vehicle, or whether, as previous studies have found, the short term effects of gasoline prices on traffic crashes are generally stronger than the delayed effects.2

If the latter is the case, then it could be we have seen as much of a lift in miles driven per vehicle or driver as can be expected. Potentially then frequency will see only moderate increases over the next several years (barring any major economic slowdown or widespread severe winter weather like in 2014); at least until market penetration of collision avoidance systems and potentially even early generation autonomous vehicles help begin to reduce claim frequency in a meaningful manner beginning in 2020.3

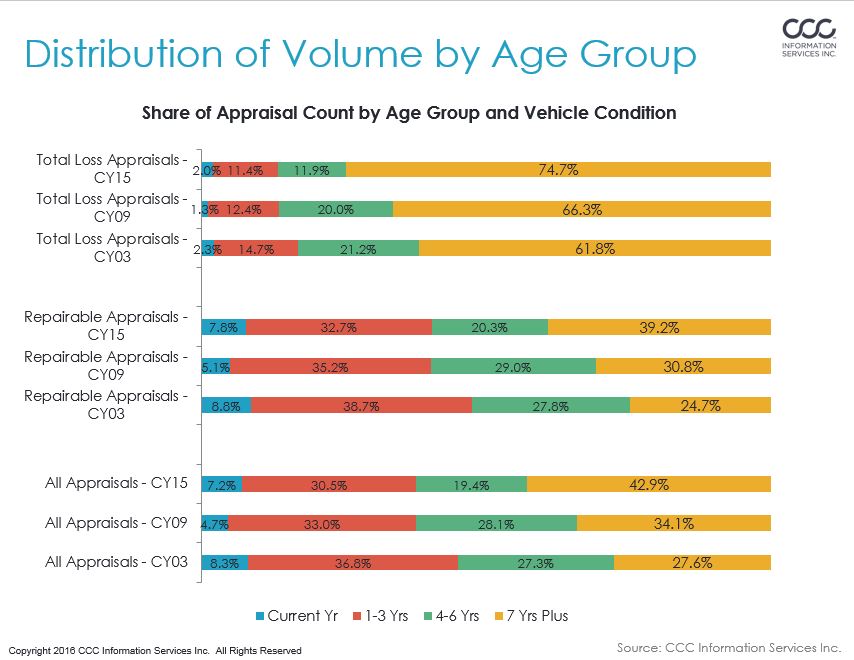

In the near term however, newer vehicles are accounting for a growing share of repairable volume again, and the industry is experiencing a reversal in some of the trends experienced during the recession. Specifically, newer vehicles tend to have more parts replaced, and a lower repair percent of total labor spend. Throw into the mix the fact that vehicles overall have gotten more complex, and these trends accelerate even further.

Forty-eight percent of vehicles with auto claims in CY 2015 were aged 6 years and older, where the greater vehicle complexity from lightweight materials, complex construction, and electronic content are not as prevalent.

By 2018 however, assuming the fleet continues its shift to newer vehicles, the industry will see growth of over 6 percent among vehicles aged 0-5 years. These will be MY 2013-MY 2018 vehicles, which based on the vehicle changes we have seen to date, as well as the further changes made so far in the new MY 2016 redesigns, these vehicles will be increasingly complex in their construction, and will offer many more options such as automatic braking, crash warning or avoidance systems, parking assist, lane departure warning, and more.

Ensuring the vehicle repair is completed in a manner that follows recommended repair procedures can also head off any potential unplanned returns of the vehicle, and leave the ever-more demanding customer unsatisfied with their repair experience.

So what can we expect in 2016 and the years ahead? Technology, data, mobility and consumer demands are changing – not predictably or linearly, but exponentially, which means we as an industry need to be ready for just about anything.

We are at an inflection point and the pace of change will be swift. Taking strategic and systematic steps to continue to modernize our technologies and business models is essential to remain competitive. Those companies that can use technology and data to guide, improve and truly create an engaging customer journey will be in the best position to respond to this inflection point.

1. http://www.investopedia.com/terms/i/inflectionpoint.asp

2. (Chi et al., 2010, 2012, 2013; Grabowski and Morrissey, 2004). Guangqing Chi, Mohammed A. Quddus, Arthur Huang, David Levinson. “Gasoline price effects on traffic safety in urban and rural areas: Evidence from Minnesota, 1998-2007.” Safety Science 59 (2013) 154-162.

3. CCC Intelligent Solutions