Smarter decision making for a smoother claims process

CCC® Predictive MOI

CCC® Predictive Solutions Method of Inspection (MOI) helps insurers make smarter decisions at the first notice of loss (FNOL), to quickly and efficiently route claims to the optimal appraisal channel. CCC Predictive MOI saves time, saves money, and allows insurers to set expectations early, improving the customer experience at this crucial moment in the claim lifecycle.

Get CCC Predictive MOIHow It Works

Using information collected at FNOL, CCC Predictive MOI uses intelligent statistical modeling to weigh the inputs against historical auto physical claims data, based on guidelines established by the insurance carrier to offer predictive recommendations to quickly and efficiently route claims to the optimal appraisal channel. The result is an efficient process with minimal waste, and a better experience for the insurer and insured alike.

A DEEP UNDERSTANDING OF BIG DATA

CCC helps insurers process approximately 12 million claims annually and holds statistically significant data for 97% of the 956 distinct U.S. Core Based Statistical Areas. Mountains of data have little value without interpretive models, which is why today over 20 insurers make decisions with CCC ONE Predictive MOI for the best start to their claims process.

THE RIGHT DECISION SPECIFIC TO THE LOCATION

The advanced data analytics of CCC Predictive MOI account for specific vehicle makes and models, as well as geographic differences, enabling more precise region-specific decision-making at FNOL. With access to significant volumes of real data points, CCC’s predictive models are highly accurate.

California

Annual Claim Volume

Northern California

Annual Claim Volume

San Francisco

Annual Claim Volume

REGION-SPECIFIC ACCURACY

Access to significantly larger amounts of data for specific years, makes and models helps considerably in raising region-specific accuracy. In 2015, for example, CCC’s data set included 757 claims for 2007 Toyota Camry LE vehicles in the San Francisco Bay Area alone.

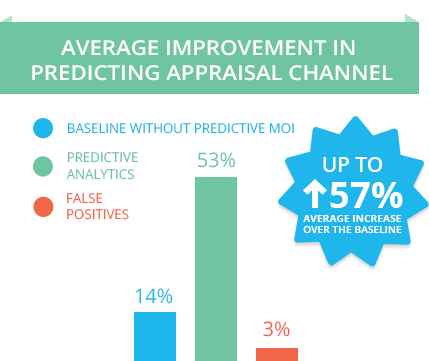

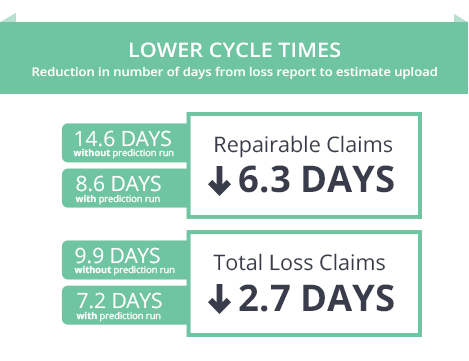

ACCURATE, EFFICIENT & COST-EFFECTIVE

Carriers using CCC Predictive MOI have seen vast improvements in the efficiency of routing repairable and total loss vehicles, up 57% from the baseline. Better predictions at FNOL reduce unnecessary rental, storage, and towing expenses, while also reducing cycle time.

EASY TO INTEGRATE, SIMPLE TO USE

CCC Predictive MOI is intuitive and easy to use, requiring minimal inputs—as low as 7 mandatory fields—at FNOL.

The data collection process is streamlined and standardized to be far less time-consuming at FNOL.

CCC Predictive MOI plugs directly into your existing claims workflow, seamlessly integrates with salvage or mobile platforms and is transferable to consumer self-service applications.

LEARN MORE ABOUT PREDICTIVE MOI

Stake Your Claims on Data

Data Science is disrupting business—as surely as electricity, telephony, connectivity and... Read More

Data—Every Insurer has its Journey

New data sources, the growth of unstructured data and more sophisticated uses... Read More

Enabling Wins with Claims Analytics

Getting claims to the right person at the right time can have a big impact on claims settlement... Read More

IT’S TIME TO STOP GUESSING AND START MAKING SMARTER CLAIMS DECISIONS

For a better, faster, more accurate start to the claims process, start using CCC Predictive MOI today.