PropertyCasualty360 recently featured the article here.

A quick view of spring 2014 and the impact weather had on carriers, claims and appraisals

Every year billions of dollars are attributed to weather related losses. The violent phenomena that cause havoc one year might not have as much of an impact the next making it difficult to anticipate weather related fluctuation of claims volume. The last several years we’ve seen the average costs of comprehensive losses increase steadily. Erratic weather patterns are most to blame for the large increases in comprehensive losses; many of the major storms in the last several years have involved significant flooding and hail and strong winds, where vehicle owners are given little warning to move their vehicles to a safer location. This past spring, severe weather made a significant impact on claims costs and frequency.

According to Aon Benfield’s Global Catastrophe Recap report, through the end of May 2014, tornado activity in the United States remained in the bottom 25th percentile of all years dating to the early 1950s. Though U.S. tornado activity in May this year remained low in relative terms, severe storms and large hail caused $1 billion in damage in the Midwest, Plains, Rockies, Mid-Atlantic and Northeast. During May 2014, overall economic losses of at least $3.5 billion were estimated and aggregate insured losses exceeded $2.2 billion in the U.S. While the occurrence of wind-related severe events were fewer through May 2014, insured losses were sizeable with large hail and damaging winds serving as the primary driver of the thunderstorm-related costs. Matthew Nielsen, a director and meteorologist at RMS, attributes 60% of average annual storm losses in the U.S. to hail damage indicating its significant economic impact.

Weather phenomena often strike unpredictability leaving the extent of the damage unknown. Consider Memorial Day weekend this year when parts of South Carolina sustained heavy hail damage. The isolated but intense hailstorm – which featured large, dense hail – did significant damage to cars, roofs, siding and windows. Tens of thousands of homes and businesses were potentially damaged with Insurance adjusters estimating hail damage to about 20,000 structures in the Richland area. The South Carolina Department of Insurance issued a bulletin immediately after the storm allowing emergency adjusters into the state to assist with damage claims. That order originally was set to expire June 13, but has been extended until Aug. 1 because of the extent of the damage¹.

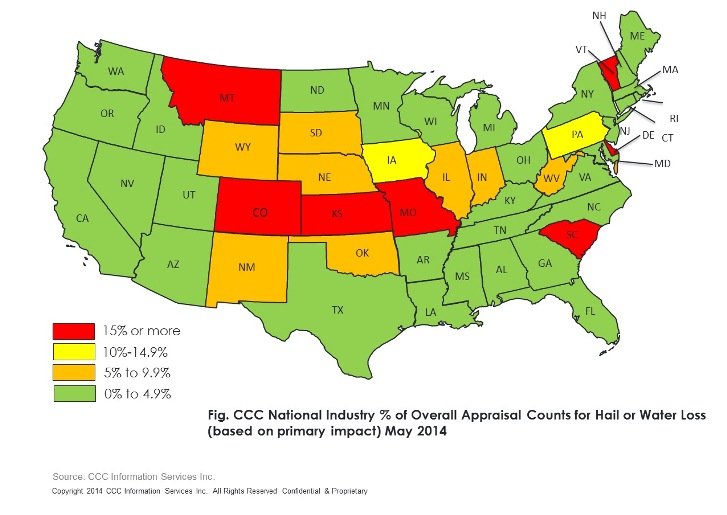

The month of May usually sees a lot of weather activity across the U.S. and that certainly held true this year. In May 2014, CCC observed that vehicle valuation counts were up 3.8% while repairable appraisal counts were up 5.5% – reflective of the significant weather events. Claim counts for all appraisals (including flagged total losses) in Illinois and Colorado – states significantly impacted by the 2014 storms, saw an uptick of 19.4% and 14.7% respectively, compared to May 2013. Hail and water losses accounted for over 5% of all vehicle appraisals for the month of May 2014 – not as bad as 8.8 % seen in May 2012 but an increase from the 4% in May 2013. Certain states such as Colorado, Missouri, Montana, South Carolina and Illinois saw large increases in May 2014 from the same month in the prior year; while Iowa, Kansas and Nebraska, states that have historically seen large hail losses had better luck this year.

More broadly, the severe weather in May 2014 also adversely impacted the industry’s financial performance as marked by the decline in ALIRT’s P&C Composite Index for both personal- and commercial-lines insurers. A sharper drop was observed among personal lines reflecting the weather-related losses in the quarter.

Though advances in weather forecasting attempt to warn us of severe weather events, the prediction of these storms far in advance is still impossible. Insurers are finding they must cater their claims service options to new consumer demands and demographics, and also develop the ability to implement process and procedures than can easily be ramped up and down post-catastrophe to handle the large fluctuations in claims volume. Though we might not be able to predict the intensity and frequency of weather phenomena, the persistence of severe weather trends could potentially cause a shift in the way an insurer responds. To combat the issues of rising costs, increased consumer demand in affected areas, and potential decreased customer satisfaction in others – companies may need to explore significant changes to handle the volatility that comes with severe weather. For an in-depth look at the impact of weather on driving claim costs and frequency please visit: cccutilities.wpengine.com/crash-course

Sources:

1 http://www.thestate.com/2014/06/30/3540717/its-raining-roofers-in-the-midlands.html

The information and opinions in this publication are for general information only, are subject to change and are not intended to provide specific recommendations for any individual or entity. Although information contained herein has been obtained from sources believed to be reliable, CCC does not guarantee its accuracy and it may be incomplete or condensed. CCC is not liable for any typographical errors, incorrect data and/or any actions taken in reliance on the information and opinions contained in this publication. Note: Where CCC Intelligent Solutions is cited as source, the data provided is an aggregation of industry data collected from customers that use CCC’s products or services and/or that communicate electronic appraisals via CCC’s electronic networks.