PropertyCasualty360 recently featured the article here.

Businesses live or die by the networks with which they connect, whether it’s connecting people or connecting businesses.

In our daily lives, most of us experience the benefits of being connected to networks. Whether we’re shopping with Amazon, booking travel with Kayak or advancing our careers and connecting with others via LinkedIn, we’re leveraging the benefits of integrated, consumer networks to make our lives easier, better, more efficient and, often, more affordable.

In the business-to-business (B2B) world networks carry many of the same benefits, and like business-to-consumer (B2C) networks, have evolved considerably over time. The leading B2B networks today become embedded into a business’ workflow, underpinning efficient processes and transactions, or more importantly, connecting trading partners and supply chains in such ways that create transparent, informed decisions and interactions that deliver exponential value to all participants.

Not all networks are created equal, so deciding which business partners to connect with becomes a critical decision for companies. How do you evaluate a network and how do you know which networks are worth your time, energy and investment? Read on. We’ll offer a perspective on choosing network partners that can deliver value to your business.

The Evolving Network

The advent of the platform

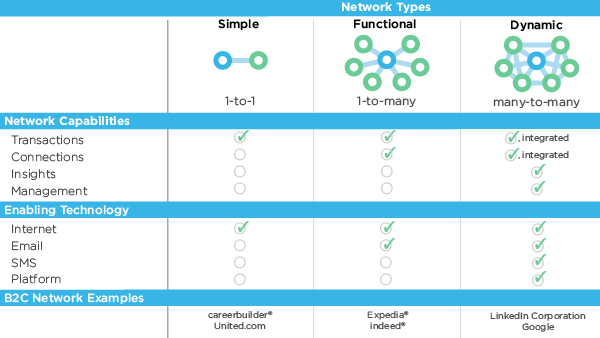

Technology advancement and complex business requirements have evolved business networks across functionality and entities, but this has not been achieved without the presence of a strong platform that enables better integration and expansion capabilities. The image below illustrates evolving networks and offers examples of companies that offer extended capabilities achieved via a robust and adaptable platform.

How Many ‘Nots’ Will You Tie Today?

A dynamic network is as much about what you don’t have to do as what you can do; it’s about eliminating steps. That’s one good way to evaluate a network. Ask yourself questions such as these about your day-to-day workflow:

- How many phone calls will you not have to make or take?

- How many manual tasks will you not need to perform?

- How many questions will you not have to answer?

- How many people will you not have to ask for help?

- How many times will you not provide outdated information?

Are you connected to the right network?

What a Dynamic Network Delivers

When is it time to evaluate your organization’s choice of network partners? Understanding what a dynamic network delivers may help you think through the best strategy for your business.

Workflow Management: Integrating everyone, everything, everywhere

Retailers, like John Lewis Partnership in the UK, do a great job of end-to-end integration.¹ When a customer buys something, the point of sale transaction instantly updates inventory, the delivery company is automatically notified, and the distribution, shipping and receiving warehouses are updated and alerted. The data from that sale is instantly available to store and corporate management for up-to-the-second, accurate business analysis. And the customer can start tracking the order the second it’s completed.

Like the John Lewis Partnership, many organizations across industries have a lot of moving parts in their network: the back office, field agents, service and supply partners, information suppliers, and of course, customers. A dynamic network intelligently takes information from anyone that enters it and makes it available to everyone that’s authorized to use it, creating a level of transparency not available in less connected networks.

Customer Expectation Management: Staying ahead of a moving target

Today, people get frustrated when it takes an extra three seconds to do something that just 15 years ago was completely impossible—like uploading a picture from a telephone.

If your customers have used Amazon, they’ve already experienced great service. If they’ve received or shipped a package, they’ve seen efficient field service networks in action. They expect that same level of service from everyone.

In addition to great service, there’s something else that a dynamic network like Amazon delivers for the customer: self-service. When customers are integrated into the network, they can manage and monitor their own accounts, request services, place orders and more. And, they expect to be able to do these things from any device they use.

A Source of Knowledge: Embedding real world intelligence back into your business

Companies that sell through reseller channels offer various kinds of knowledge to participants in their partner networks – from individual analysis of the particular partner’s business to an aggregated analysis based on the business performance of network participants. Altogether, the combined data pinpoints inefficiencies in the business, spotlights strengths and provides the intelligence to make smart, competitive decisions moving forward.

Dynamic networks generate large amounts of data, requiring large investments to manage and analyze that data. Most companies rely on providers to handle this task, giving the participants the advantages of Big Data analysis without the cost of hardware, software and the people that keep them running.

Fewer Steps: Supporting every part of the workflow from a single platform

Sophisticated banking networks are dynamic. Fiserv, one of the four companies that provide 96 percent² of U.S. banking software, has a portfolio of products. A single one of those products has 26 separate components that provide end-to-end solutions to enable services both externally and internally.

Few businesses are as complex and as heavily regulated as banking, but many businesses have the same need for a dynamic network that delivers the “whole product”. It streamlines the efficiency of the operation by eliminating the need to log-in to multiple networks or applications to get a task completed.

Networks for Auto Physical Damage Claims

An Auto Physical Damage (APD) network is about efficient, cost-effective business operations while providing great customer experience. Today, insurance carriers face competitive demands—such as immediacy, accuracy, simplicity and efficiency. Your networks are important in achieving your business imperatives, and a dynamic APD network is key for achieving your business goals.

Consider the value of a dynamic network when handling a single claim:

Managing the Workflow

From assignment to settlement, multiple entities get involved in a claim, ranging from insurance appraisers, adjusters, repair shops, parts suppliers, rental car companies, salvers and more. A dynamic APD network enables these entities to stay informed about a claim, moves the claim through the workflow in an efficient manner and enables a better focus on exceptions with data-supported, predictable outcomes.

Meeting Customer Expectations

The customer is always in the loop. When the adjuster completes the estimate, the required information is delivered on the spot. If a car is getting repaired, the customer is kept updated about the repair. Similarly when total losses occur, self-service capabilities enable customers to understand the valuation better. During and after an accident, satisfaction is monitored, providing a chance for improved service.

Providing Strategic Knowledge

All data about a claim is captured, securely stored and used to provide detailed analyses and reports, including business performance, trends and patterns, forecasts and more. The information models can contribute to earlier decision-making for improved performance and service.

Saving Steps

A dynamic network connects all players on a single platform providing every participant with the right information at the right time. Being integrated into the network reduces the need to re-enter information in multiple systems, enables better record keeping and tracking, and minimizes the need for phone calls.

If any of these benefits address concerns in your existing business processes, you may be ready to evolve to a more dynamic network. To learn more about the CCC APD claims network, please visit cccutilities.wpengine.com.

Click here to download a PDF of the article.

¹ http://logisticsviewpoints.com/2012/06/04/john-lewis-excels-at-mutichannel-retailing-and-fulfillment/

² http://www.americanbanker.com/issues/178_194/can-big-four-core-banking-vendors-oligopoly-be-broken-1062654-1.html