(As published in Insurance Networking News.)

Using driver data to help improve claims performance and deliver policyholder value

In our connected world, data has become instrumental in informing and transforming how insurance is priced, packaged, delivered and serviced. For an example of this, you don’t need to look any further than telematics, where driving data assists insurers in making strategic product decisions and has become an attractive component of policyholder recruitment and retention efforts. For their participation, policyholders get pricing discounts and tips on how to be safer drivers, frequently with the potential for earning additional rewards for driving improvements. This model is powerful when executed well, but it’s only one part of the telematics value proposition.

Bringing telematics data to the claims organization holds tremendous promise, both for the insurer and the consumer. The problem, though, is how to operationalize telematics data in ways that are actionable, but minimally disruptive to existing workflows. In a not too distant future, this will be possible and it can help make participating insurers more attractive to consumers throughout the insurance and claims experience.

Telematics Data Helps Inform, Improve Claims

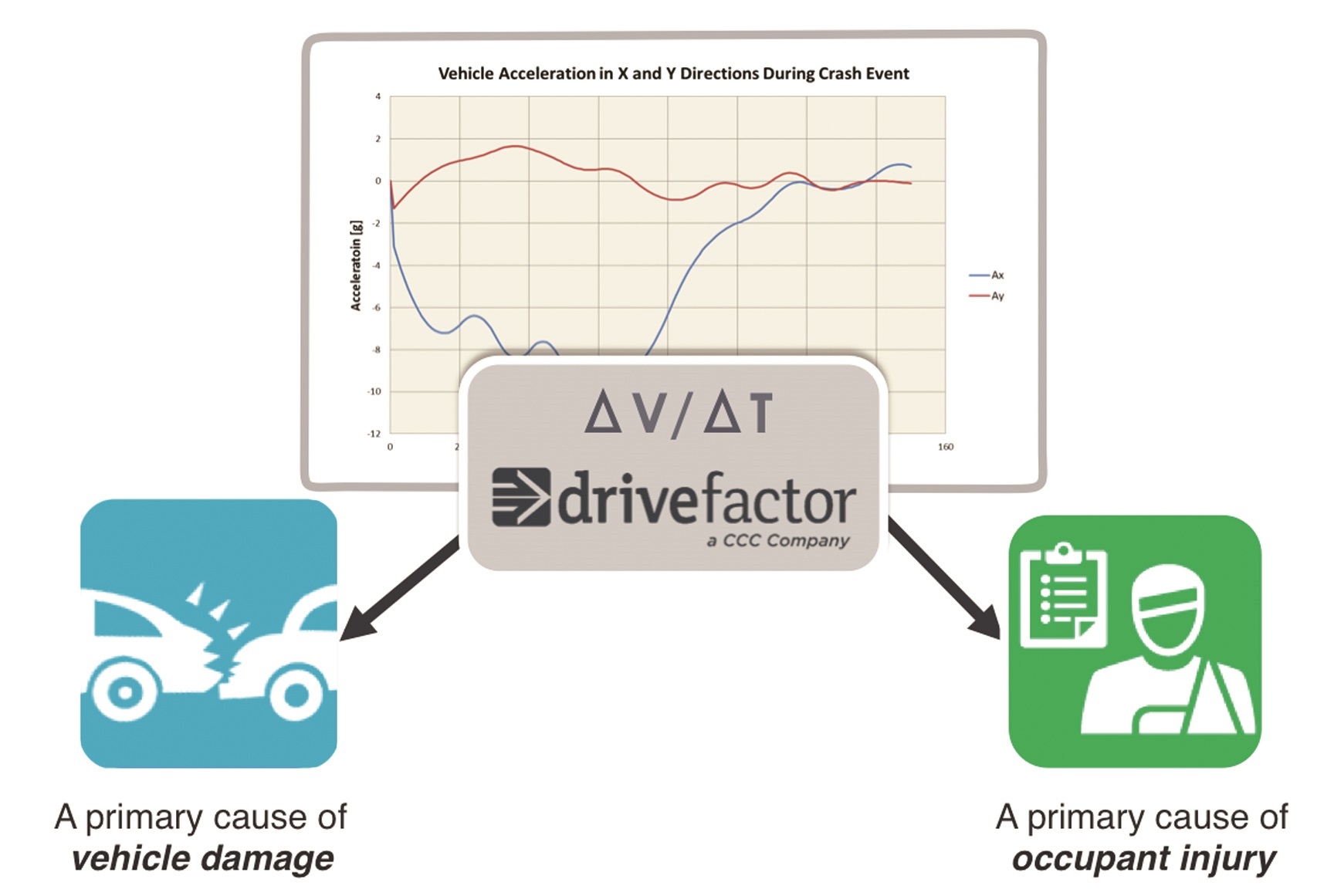

An accident occurs in less than a second, but the data derived in that second, and the brief timeframe before impact, can yield enough information to determine driving events and behavior. The image below illustrates what our telematics platform may see during an accident, a visual representation of the physics of that accident. In addition to acceleration, pertinent information, such as hard breaking and steering, location, speed and air bag deployment, may also be captured, transmitting, a fact-based account of the accident to your front line staff.

Be Smarter. Act faster. Serve better.

From this data, insights about the crash can be derived, and when integrated with claims management software, it can help inform and speed decisions related to the vehicle and its occupants. It can also serve as the impetus for immediate, proactive communication from insurer to policyholder, initiating emergency and vehicle services to arrive at the scene, and addressing the needs of your policyholder in an instant

Imagine a process where upon impact, your first notice of loss (FNOL) team is notified that a policyholder has been in an accident, and the facts of that accident pre-populate a loss intake screen. Gone would be the need for Q&A scripts to obtain those already-captured details, and in their place would be interactive FNOL, a process that enables your team to proactively manage the accident scene.

What if this same driving data also went to work pinging your predictive analytics solutions, assisting you in making a quicker repair versus total decision, or identifying the potential for injury? This could all happen in minutes instead of hours, saving time and unnecessary expenses, such as towing or storage fees. And, your policyholder? They would benefit from the additional services you could provide at the scene and the transparency and speed with which claims resolution occurred. It should all be possible – provided you have the right technology and data sets in place to make actionable and repeatable use of the driving data.

If you’re interested in learning more about telematics and claims integration, please visit DriveFactor, a CCC company, at www.drivefactor.com/claims or contact me at steve.mckay@drivefactor.com.