(This article was first published in Property Casualty 360.)

Since the first cars were sold, there have been crashes. And while the insurance claims industry has made enormous advances over the years, the fundamental process of handling a claim has been largely the same for decades – at least during my time in this industry, which spans nearly 30 years and includes research and work in claims and the application of “black box” information in the evaluation of liability and injury causation.

A crash occurs. At some point later the insured or claimant calls an insurer’s first notice of loss department. Collected facts about the accident are used to make initial assignments for vehicle inspection and claim handling. For both auto physical damage (APD) and casualty claims, a variety of steps follow to set appropriate reserves, investigate the claim, monitor the restitution processes and settle the claim. And throughout these steps, speed, accuracy and customer satisfaction are the gold standards for performance.

How far could you transform that process if you had detailed, sensor-based information about the crash at the exact time it occurred? By integrating telematics and driving data into the claims process, you can do exactly that.

Let’s examine the possibilities.

Reinventing First Notice of Loss

Imagine a process where upon impact, your first notice of loss (FNOL) team is notified that a policyholder has been in an accident, and the facts of that accident pre-populate a loss intake screen. Gone would be the need for Q&A scripts to obtain those already captured details, and in their place would be interactive FNOL, a process that enables your team to proactively manage the accident scene and consequently provide even better customer service, and achieve better outcomes in terms of claim resolution speed and accuracy.

How does this come to life? Consider the following scenario. Your insured approaches an intersection with a traffic light and stops in the left hand turn lane because the light is red. Your insured signals a left turn and then proceeds on the green signal. During the turn, an oncoming vehicle fails to stop and collides with the passenger side of your insured’s vehicle at the B-pillar. Your insured is driving a late model Chevrolet Suburban. First, within one minute of the collision, the vehicle contacts your FNOL department and gives you the date and time of loss and gives you information about the insured, the vehicle and its coverages. The insured’s cellular contact information is also provided along with the following initial accident facts:

• Weather at the scene of the accident;

• An additional occupant is in the right front passenger seat in the vehicle (from the seat belt and/or airbag sensors in the seat);

• An indication of the point of impact and crash severity from the accelerometers in the vehicle, and in this instance the indicators show a passenger side impact and a high degree of severity; and

• An indication of injury probability from the accelerometer and occupant position data.

Based on GPS data transmitted by the insured’s vehicle your systems provide the exact location of the accident, color coded tracking is provided to show where the vehicle was traveling prior to the accident event, where the vehicle traveled in the five seconds immediately preceding the accident, and the estimated point of impact and the post collision movements of the insured’s vehicle.

In this example accident, the transmitted accelerometer data from the insured’s vehicle yields a calculation that the acceleration of the insured’s vehicle is an impact-related change in velocity (or ΔV) of 25 mph. The sciences of accident reconstruction and impact biomechanics tell us that a very serious injury can occur to occupants, especially near side occupants, in collisions of this impact direction and severity. Armed with this information, you automatically contact your insured, gather any additional information about the accident and potential injuries and assure them help is on the way. Your team simultaneously alerts and dispatches necessary emergency services, providing them with known information about the accident and potential for injury.

Let’s now step back and examine what just happened. Your claims organization has just fundamentally changed the relationship with your insured. You have provided time-critical, potentially life-saving services to the insured and/or insured’s family in a true emergency.

Transforming APD Claims

A 2014 study by Accenture found that customers who submitted an insurance claim in the past two years were almost twice as likely to switch insurers in the next 12 months, compared to those who have not submitted a claim: more specifically 41 percent compared to 22 percent.¹ In the context of the assistance provided in the previous example, reason suggests that customer loyalty will be enhanced rather than creating a desire to shop their insurance.

In addition to emergency services, numerous other transformational capabilities can be deployed in the claim process. For example, based on the accelerometer and point of impact data, analytics can determine the likelihood of the vehicle being drivable as well as the likelihood of the vehicle being repairable versus a total loss. In this accident example, the vehicle will not likely be drivable and your organization can immediately deploy the closest towing service provider in your network. It is also possible to arrange for a rental car to arrive at the accident scene. When the towing service provider arrives, based on analytics of the data from the vehicle, the tower completes a series of complementary investigative tasks which were automatically generated and transmitted when the assignment was made. For example, a series of photographs or videos of the accident scene are taken (e.g., skid marks, resting position of vehicles, posted speed limit) and other important information such as the VIN of the other vehicle and contact information of the driver of and occupants in the other vehicle are documented. Coupled with the data from the insured’s vehicle, the claim organization will now have the essential information to reconstruct the accident and assess liability within minutes. As an example, let’s assume the striking vehicle in the accident was a lightweight passenger sedan. Newtonian physics tells us the necessary pre-impact speeds of the striking vehicle to achieve the accelerations experienced by the insured’s vehicle. As a result, it would be important to consider the posted speed limit at the accident scene because it is likely that the striking vehicle was speeding, and thus potentially contributing to its failure to stop. As previously noted, analytics based on the vehicle’s accelerometer and point of impact data can also determine the likelihood of the insured’s vehicle being repairable versus a total loss. If the vehicle is likely a total loss, it can be towed directly to the salvage yard. Alternatively, if the vehicle is repairable, repair facilities that are in your insured’s profile and are closest to your insured’s residence with schedule availability can be identified. These choices can be delivered to the insured via your company’s mobile phone app. Based on the insured’s choice, the vehicle is taken to the repair facility.

From a repairer perspective, access to more information about the accident can have a positive impact on cycle time, efficiency and customer satisfaction. Repairs could be scheduled before a car even arrives at the shop, and the essential parts to repair the vehicle could be ordered earlier in the process from the most cost effective source. These choices can be measured within minutes of the accident rather than in days. As a result, unnecessary time and expenses associated with multiple tows and storage can be minimized. Within this same time frame, analytics can also provide estimates of your loss exposure for both auto physical damage and casualty claims and give you recommended assignments of negligence that will assist in subsequent subrogation activities.

Integrating with Casualty Claims

Later, in the management of claims, these metrics offer the capability to examine results based on similar accident and injury events. For example, in the various accident types shown in Figure A, it is possible for an occupant to experience a neck strain injury. Would management expect a neck strain to settle for the same amount for these different impact scenarios?

Clearly no. Through the use of acceleration and impact direction data, claim resolutions can be reviewed based on the same types of events in terms of impact direction and severity. This approach is an important distinction from reporting capabilities today. Today, the industry can review the average cost of a neck sprain/strain in a given jurisdiction. The state of tomorrow will allow us to review the average cost of a neck sprain/strain in a given jurisdiction for the same type and severity of impact. This distinction may be as important to measuring claims performance as the distinction between batting average versus on-base percentage in the movie Moneyball. How can all of this happen? The key is linking auto physical damage data to casualty data. This capability has eluded our industry for decades. Our research tells us that the fundamentals to linking APD data to casualty data is recognizing and capturing the key common denominators to the data (assuming, of course, that you have sufficient quantities of data).

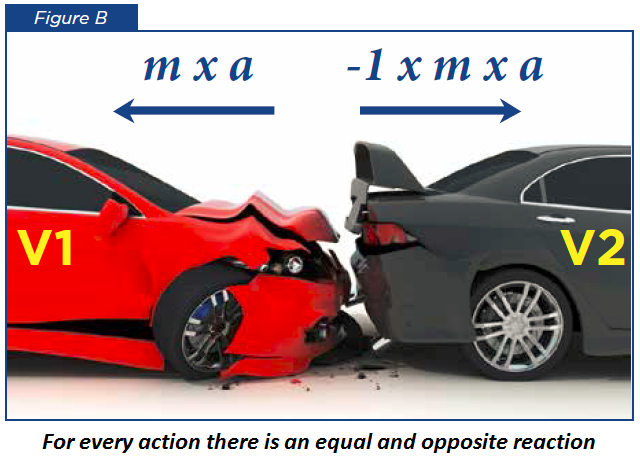

What are the common denominators? Newtonian physics and acceleration. Newton’s second law states that the relationship between an object’s mass m, its acceleration a, and the applied force F is F = ma. Newton’s third law states that for every action there is an equal and opposite reaction. This means that certain aspects of real world accidents can be represented by equations, which can be solved. For example in a two car collision see Figure B. Variables in the above equation are either known (such as vehicle mass), can be calculated, or measured with telematics solutions (such as vehicle acceleration). Since the same collision event creates the auto physical damage, the injury and the accelerations, it is logical to examine all of this data when analyzing the implications of linking the data.

When we do so, the data behaves the way we expect it to. These relationships have been

validated when independently investigated public accident data are linked to CCC data.

More specifically:

• Bigger “hits” (or accelerations measured in terms of change in velocity or ΔV) create higher probability for more expensive repair costs and total loss;

• Bigger “hits” create higher probability for injury and more serious injury;

• Impact direction “matters” (front versus rear versus side); and

• Acceleration is more descriptive of an accident than repair costs when linking to injury data. This is because vehicles with more expensive to repair components distort comparisons with vehicles that contain less costly components.

Based on these data relationships and data created and captured by CCC technologies today, smart analytics can inform claim decisions and processes in a simple and non-disruptive way.

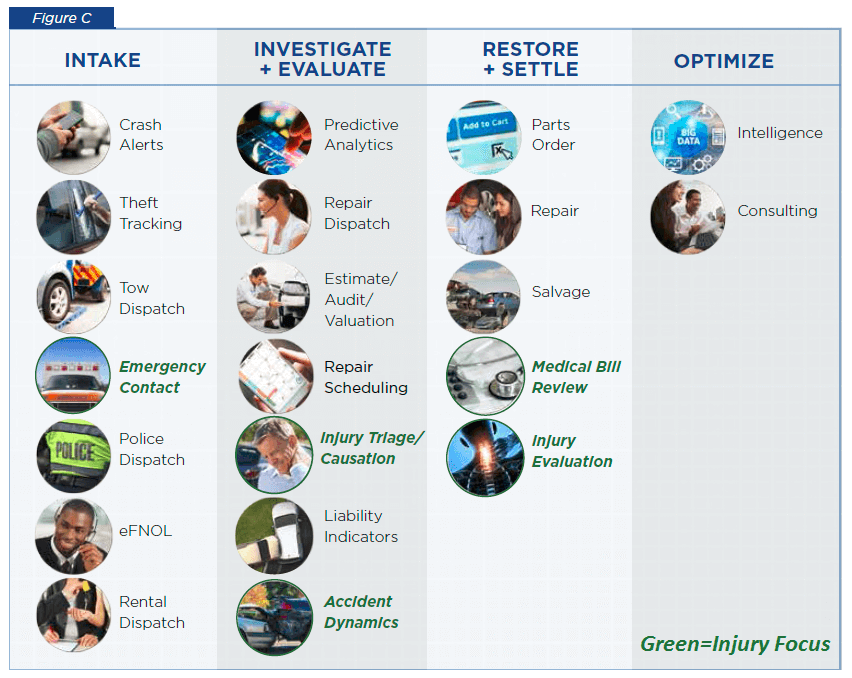

When telematics are integrated with claims:

• Telematics data create the myriad opportunities to improve claims processes and outcome for both auto physical damage and casualty claims (Figure C);

• Telematics data ultimately helps determine the cause (both liability and legitimacy) and severity of both auto physical damage and injury claims; and

• The framework for how claims performance is measured and subsequently improved can be transformed.

Interested in learning more about how telematics and forensic analytics can help automobile insurers better understand what happened in an accident, collision severity, and the likelihood of occupant injury? Contact me at: spalmer@cccis.com.

Sources:

1 Accenture, “The Digital Insurer Claims Customer Survey: Why claims service matters.” 2014. www.accenture.com/digital insurer.

Learn more about Telematics Applications for APD and Casualty Claims

Fill out the form and download this article as a PDF