Originally featured on CollisionWeek.com

The U.S. finalized new fuel economy standards in August 2012, that require each manufacturer’s fleet to achieve average fuel economy of 54.5 miles per gallon for cars and light-duty trucks by model year 2025. These standards extended the requirement already in place for a manufacturer’s vehicles by model year 2016 to reach 35.5 mpg.

In anticipation of higher fuel economy standards coming in 2016, automakers have ramped up their small car production where competition is fierce. Ford and GM have introduced strong products in a segment traditionally dominated by the Japanese and Korean manufacturers. In an attempt to drive up prices and profits, and attract younger more technically demanding customers, many of these vehicles are loaded with content.

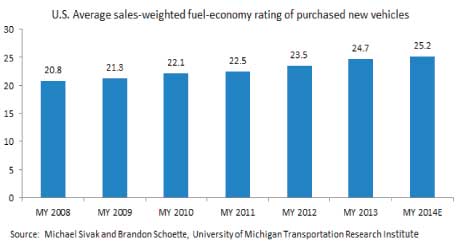

Automakers have also started to manufacture larger volumes of crossover vehicles, placing the SUV onto more fuel-efficient car platforms. According to data from the University of Michigan Transportation Research Institute, the average fuel economy of all vehicles sold in calendar year 2013 was 24.8 mpg, up 1.0 mpg from 2012 and up 3.9 mpg from 2008.

Time to shed some weight

As automakers race to meet the ever stricter corporate average fuel economy standards, they are looking at many ways to meet these new standards – tweaking existing engine technologies; adoption of hybrid, electric or hydrogen engines; broader adoption of start and stop technology; more electric power steering more efficient air conditioning compressors; tweaked transmission shift intervals, etc.

One of their key challenges is to reduce the overall weight of the vehicles themselves. This has driven up the use of lighter-weight metals such as aluminum and magnesium by automakers. As technology reduces the cost and speed of vehicle development through advances in electronic modeling and CAD systems, manufacturers can now select different materials and joining methods within a single vehicle body structure. The result is a potential combination of materials: ultra-high strength steel, high strength steel, mild steel, aluminum and tailored blanks all used in a single vehicle structure.

Material Changes

As the industry shifts away from larger, heavier vehicles towards smaller, lighter-weight vehicles, there will be impacts across numerous industries. Steel, aluminum and plastic are three primary vehicle materials, yet development of new alloys and fabrication methods may help reduce the amount of material needed while increasing strength and performance.

Research predicts steel will remain the dominant structural material used for most passenger vehicles in the future, although the number of alloys will increase from four (typical only five years ago) to more than twenty.

With the weight of aluminum nearly three times lower in density than steel, expanded use of aluminum is underway. Drucker Worldwide expects the automaker’s use of aluminum to increase dramatically by 2025, growing from 200 million pounds in CY 2012 to 1 billion in 2014, and to between 3.2 billion and 6.4 billion pounds by 2025.

Individual part component analysis reveals that hoods, front bumper impact bars, fenders, radiator support upper tie bars, absorbers and lift gates are the components which see most frequent aluminum usage (disregarding the engine and wheels).

The steel industry will face stiff competition from the aluminum industry, which is responding by producing more advanced high-strength steel, and promoting their lower cost and flexibility (for the automakers and the repairers).